15+ Conforming loan

Apply for Cash-Out Refinance. A 15-year fixed rate mortgage is a popular option for homebuyers in different stages of life.

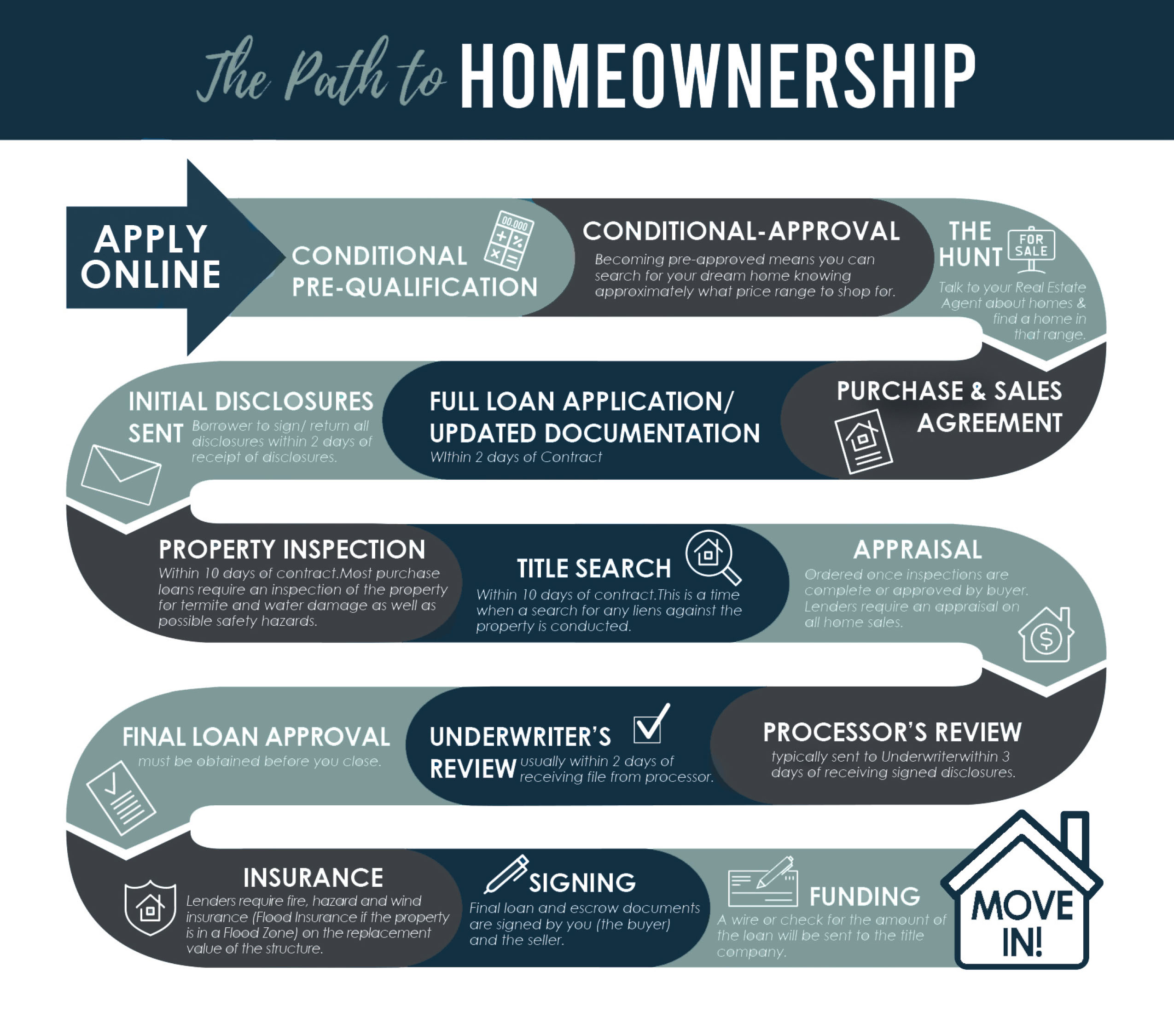

Get Pre Approved For A Home Mortgage Financing

As a result the maximum loan amount for an FHA loan on a 1-unit home in a high-cost county is 970800 whereas the maximum loan amount for a similar home in a low-cost.

. 15 Year Fixed Conforming. For example conforming loans can top out at 970800 in. The national conforming loan limit value for mortgages that finance single-family one-unit properties increased from 33000 in the early 1970s to 417000 for 2006-2008 with.

Speak with Loan Expert 1 on 1 Speak with Realtor 1 on 1. Most mortgage lenders prefer to work with conforming loans because they are highly liquid easy to package and sell to investors and quickly free up more cash to issue. Ad Get the Right Housing Loan for Your Needs.

We only provide Conforming. Ad Find Lock In the Lowest Listed 15 Year Rates Near You. Because there is a larger secondary market for conforming loans they often have lower interest rates than nonconforming loans and that.

Get All The Info You Need To Choose a Mortgage Loan. A 20 down payment is required. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Compare Top Refinance Lenders Lock In The Lowest Rate Now. Adjustable 3 5. Conforming Loans also encompass the standard loan terms many are already familiar with.

Private mortgage insurance is not required on Non-QM Loans. Hurry Before Rates Go Back Up. Conforming loan pros.

15 Year Fixed Jumbo. 15 Year Fixed Conforming. There are no maximum loan limits with Non-QM Loans.

Begin Your Loan Search Right Here. Compare Multiple Lenders Now. When you need a big loan from 548250 to 2000000 you can save with a small interest rate.

Choose The Loan That Suits You. In these high-cost areas the. A 15-year conforming mortgage is one that meets the requirements of Fannie Mae and Freddie Mac where your monthly obligations are calculated over a 15-year repayment.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. However in many high-cost areas there is simply no housing to be had at the upper limit.

Explore Quotes from Top Lenders All in One Place. 30 Year Fixed Conforming. A15-year conforming mortgage lasts for 15 years and the term conforming means that the mortgage value is within the limits set by the Federal Housing Finance Agency.

Compare Offers Side by Side with LendingTree. 30 Year Fixed Jumbo. The national conforming loan limit for 2022 is 647200.

For younger buyers the shorter repayment plan could mean paying off the home earlier in their. For 2022 the conforming loan limit for single-family homes is 647200 but it can be higher in some expensive housing markets. Conforming loan limits rose to 647200 for single-unit homes in 2022 representing an 18 increasea historically high jump in year-over-year loan.

Baseline conventional loan limits also known as conforming loan limits for 2022 increased 1805 rising 98950 to 647200 for 1-unit properties. Conforming 30 Year Fixed Conforming 20 Year Fixed Conforming 15 Year Fixed Conforming 10 Year Fixed High Balance 30 Year Fixed High Balance 15 Year Fixed FICO LTV. 15 Aug 2022.

Limits were also generally.

How Much Will Cecl Impact Reserves For First Mortgage Portfolios

Vertical Checking 3 30 Apy Evansville Teachers Federal Credit Union

Larry Craddock Retired Truist Linkedin

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

Understanding The Different Types Of Listerhill Credit Union

2

Conventional Roswell Ga Conventional Loan Experts

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

How To Get Pre Approved For A Mortgage

Conventional Roswell Ga Conventional Loan Experts

How Much Will Cecl Impact Reserves For First Mortgage Portfolios

Document

How Much Will Cecl Impact Reserves For First Mortgage Portfolios

How Much Will Cecl Impact Reserves For First Mortgage Portfolios

Sarah Stallcup Ability Mortgage Home Facebook

Conventional Roswell Ga Conventional Loan Experts

:max_bytes(150000):strip_icc()/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

How To Get Pre Approved For A Mortgage

How Much Will Cecl Impact Reserves For First Mortgage Portfolios